China cuts benchmark lending rates as policy easing picks up

中国下调贷款市场报价利率

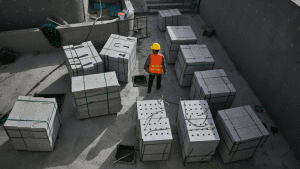

Economic growth has lagged this year on trade weakness and property sector woes

受贸易和房地产疲软拖累,中国经济在放开防疫限制6个月后仍未满血复活。

China has cut two benchmark lending rates for the first time in almost a year as policymakers push ahead with cautious monetary support in an effort to spur more robust growth in the country’s struggling economy.The one-year loan prime rate (LPR) was reduced by 10 basis points to 3.55 per cent, the People’s Bank of China said on Tuesday, while the five-year equivalent rate was lowered to 4.2 per cent from 4.3 per cent.

中国已下调两项基准贷款利率,均为近一年来首次下调。政策制定者正在推进谨慎的货币支持措施,以刺激陷入困境的中国经济实现更强劲增长。

The rates, which are set by major banks and influence the cost of borrowing for businesses and households, indicate authorities’ latest effort to shift the policy framework towards easing as concern mounts over the trajectory of the world’s second-biggest economy.

中国央行(PBoC)周二宣布,1年期贷款市场报价利率(LPR)下调10个基点,至3.55%,5年期LPR从4.3%下调至4.2%。

China’s economy has failed to fully rebound six months after authorities unwound severe Covid-19 restrictions that had been in place for three years, with growth under pressure from trade headwinds and weakness in the property sector, which accounts for more than a quarter of activity.

LPR根据各大银行的报价设定,它影响企业和家庭的借贷成本。眼下人们对全球第二大经济体未来走势的担忧与日俱增,中国当局正努力将政策框架转向宽松,下调LPR就是这一努力下的最新举措。